5 Effective Ways to Reduce Chargebacks on Stripe

Each chargeback can trigger significant fees and potentially lead to Stripe account closure. Let's take a look at how to protect your business from chargebacks.

Posted by

Related reading

Stripe Radar: Machine Learning vs. Radar for Fraud Teams – What's the Difference?

Stripe Radar and Radar for Fraud Teams are two fraud prevention tools with difference pricing and fees. We'll compare them and help you decide which one is right for you.

Introduction

For businesses utilizing Stripe for payment processing, chargebacks and fraud can be a critical concern, especially for newer accounts. A single chargeback can trigger significant fees and potentially lead to account closure.

It's crucial to establish robust defenses against fraudulent activity to safeguard your revenue and maintain your account's standing. Below are five vital strategies to secure your Stripe account against chargebacks and fraud.

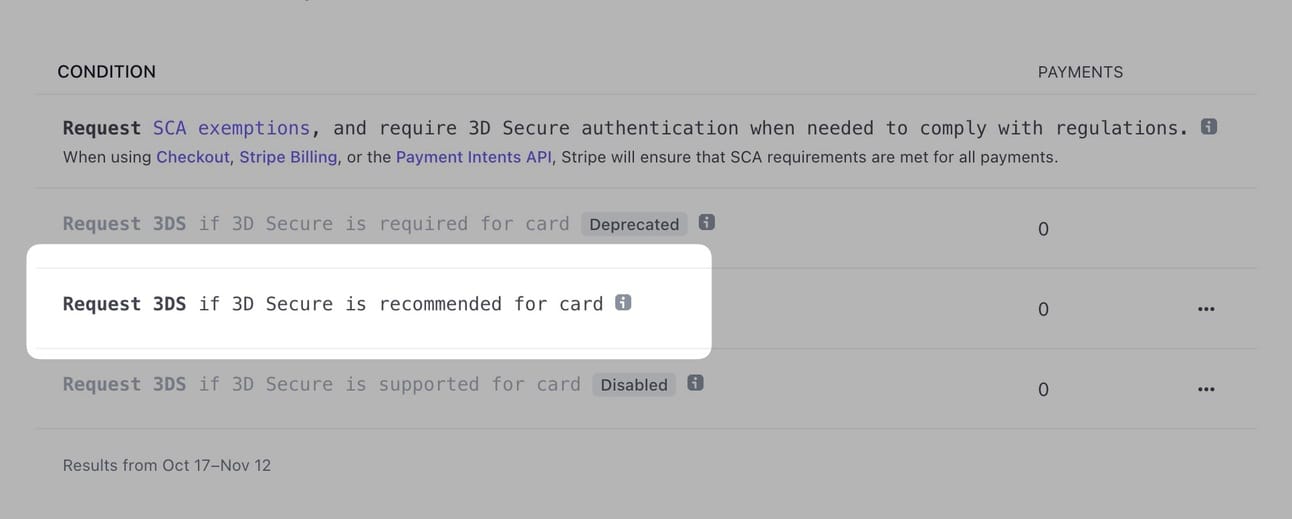

1. Implement 3D Secure Authentication

Introducing an extra layer of security through 3D Secure (3DS) can significantly decrease fraudulent transactions.

Stripe's Radar, a machine learning tool included with standard accounts, already offers great protection but can be enhanced by utilizing 3DS whenever possible. By enabling a Radar rule that requests 3DS based on card issuer recommendations, your business can further secure each transaction.

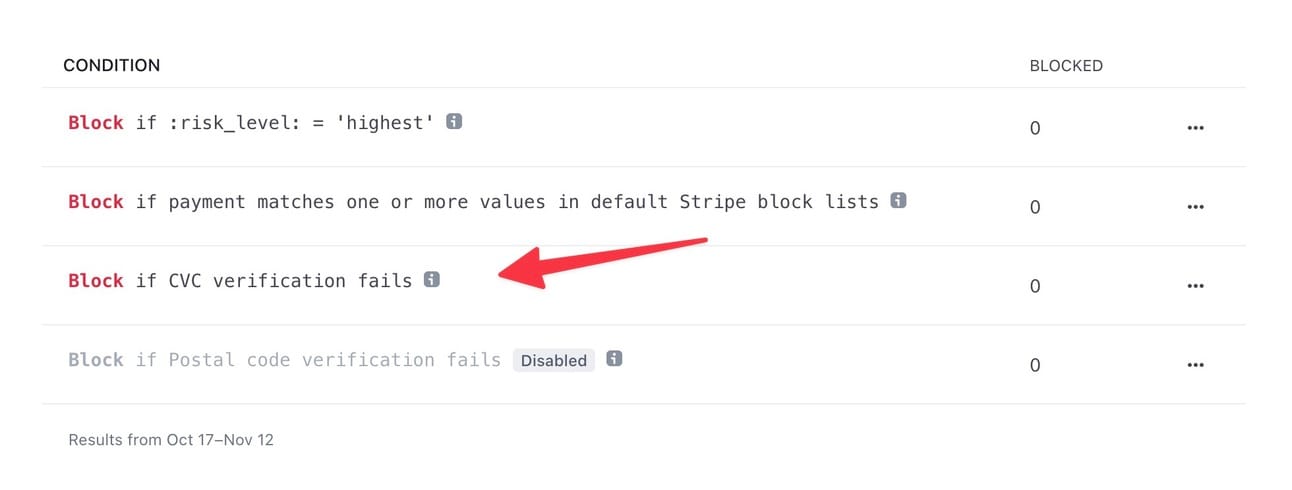

2. Enforce Card Verification Code (CVC) Checks

One of the simplest yet most effective measures to prevent fraud is to verify the card's CVC. Ensure that your Stripe account settings are configured to reject transactions if the CVC check fails.

This setup helps prevent unauthorized payments and minimizes the risk of chargebacks due to stolen card information.

3. Conduct Preemptive Refunds

When encountering any suspicious activity, such as duplicate payments, questionable email addresses, or alerts from Stripe's Early Fraud Warning system, it's advisable to issue a refund proactively.

While it may feel counterintuitive, refunding potentially fraudulent transactions can save you from the much larger headache of chargebacks and the associated fees.

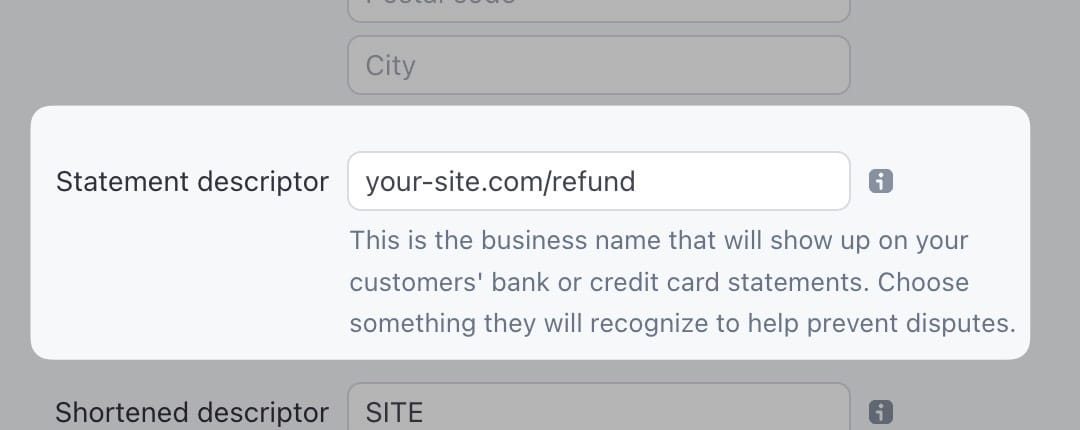

4. Streamline the Refund Process for Customers

To reduce the likelihood of chargebacks, provide clear and accessible refund policies. Include a direct refund link on your landing page, within your FAQ section, and in the statement descriptor that appears on customer bank statements.

Also, keep the lines of communication open by offering responsive customer support, addressing concerns promptly before they escalate into disputes.

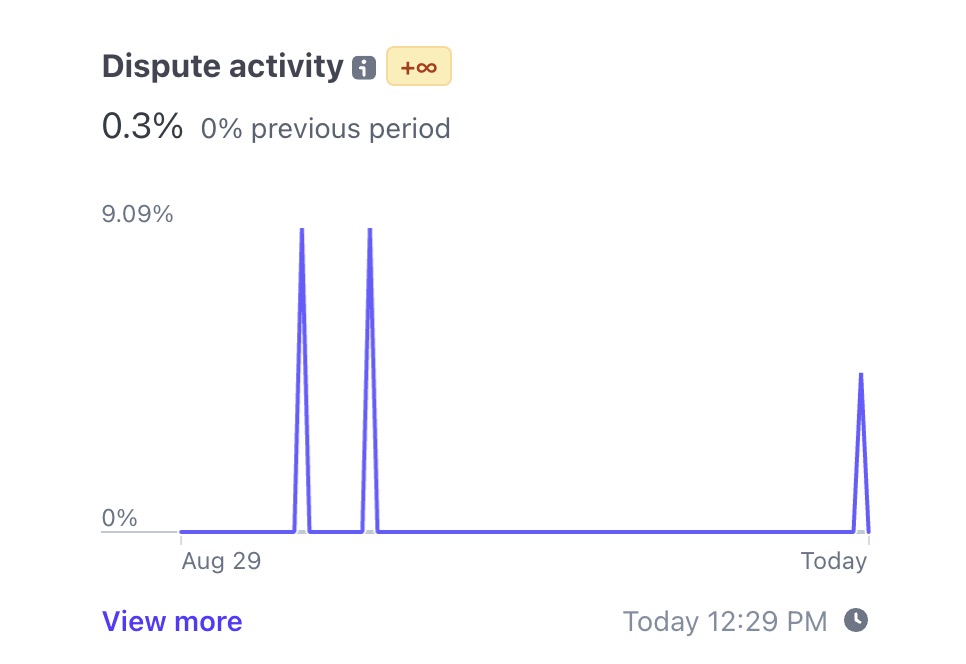

5. Handle Disputes Wisely

If a dispute occurs, reach out to the customer immediately and propose a resolution, such as a complimentary product or service alongside their refund, in exchange for withdrawing the dispute.

Should the situation advance to the dispute resolution process, be ready to provide evidence demonstrating customer engagement and their use of the product or service. Documentation such as usage logs or API records can be compelling proof.

6. Bonus Tip: Opt for Advanced Dispute Prevention Services

Enhance your fraud prevention arsenal with services like ByeDispute, which offer sophisticated features to preempt disputes.

These tools verify the validity of customer emails, detect duplicate payments, and check for stolen credit cards, keeping chargebacks at bay. Investing in such services can significantly safeguard your Stripe account's integrity and your business's revenue.

Conclusion

By integrating these strategies within your Stripe account's operations, you'll effectively reduce the risk of chargebacks and fortify your defenses against fraudulent transactions. Remember that maintaining rigorous security measures and delivering exceptional customer service are your best weapons in the fight against fraud.

Secure your transactions, instill confidence in your customers, and enjoy a smoother, more reliable payment processing experience with Stripe.