Understanding Stripe Fees: A Comprehensive Guide

Stripe fees can be confusing. We'll break down the different fees and how to calculate them. We'll also cover how to reduce your Stripe fees.

Posted by

Related reading

Stripe Radar: Machine Learning vs. Radar for Fraud Teams – What's the Difference?

Stripe Radar and Radar for Fraud Teams are two fraud prevention tools with difference pricing and fees. We'll compare them and help you decide which one is right for you.

What is Stripe?

Stripe is a comprehensive payment processing platform designed to facilitate online and in-app transactions. It's a one-stop shop for handling everything from secure credit card payments to direct bank transfers. With Stripe, you can accept payments from around the globe, manage recurring subscriptions, and much more.

Stripe Standard Account Fees

With the Standard plan, there are no setup fees, monthly fees, or hidden charges. You pay only for what you use, which makes Stripe a great option for businesses of all sizes. Let’s delve into the specific fees you’ll encounter:

1. Per Transaction Fees

Each successful card charge incurs a fee of 2.9% + 30¢. The simplicity of this structure means that regardless of the type or brand of card used by your customer, the fee remains the same.

For example, if you process a $100 payment, the fee would be $2.90 (2.9% of $100) plus $0.30, totaling $3.20.

2. Additional Fees for Special Circumstances

- Manually Entered Cards: If you enter card details manually, an additional fee of 0.5% applies.

- International Cards: Transactions with cards from outside your country will incur an extra fee of 1.5%.

- Currency Conversion: If the transaction requires a currency conversion, a fee of 1% is added.

3. Bank Debits and Transfers

For bank debits like ACH Direct Debit, expect a fee of 0.8%, although there’s a cap at $5. This means large transactions won’t incur exorbitant fees.

4. Additional Payment Methods

Stripe also enables you to accept other payment methods such as iDEAL, which start at 80¢ per transaction. As payment preferences vary by region, supporting local methods can significantly boost conversion rates.

5. Included Features at No Extra Cost

Stripe’s Standard account comes packed with 100+ features, including:

- Embedded and customizable checkouts

- Recurring billing and subscription management

- PCI compliance to help safeguard payment information

- Multi-currency support, covering 135+ currencies

- Unified payouts and real-time reporting tools

- 24/7 customer support

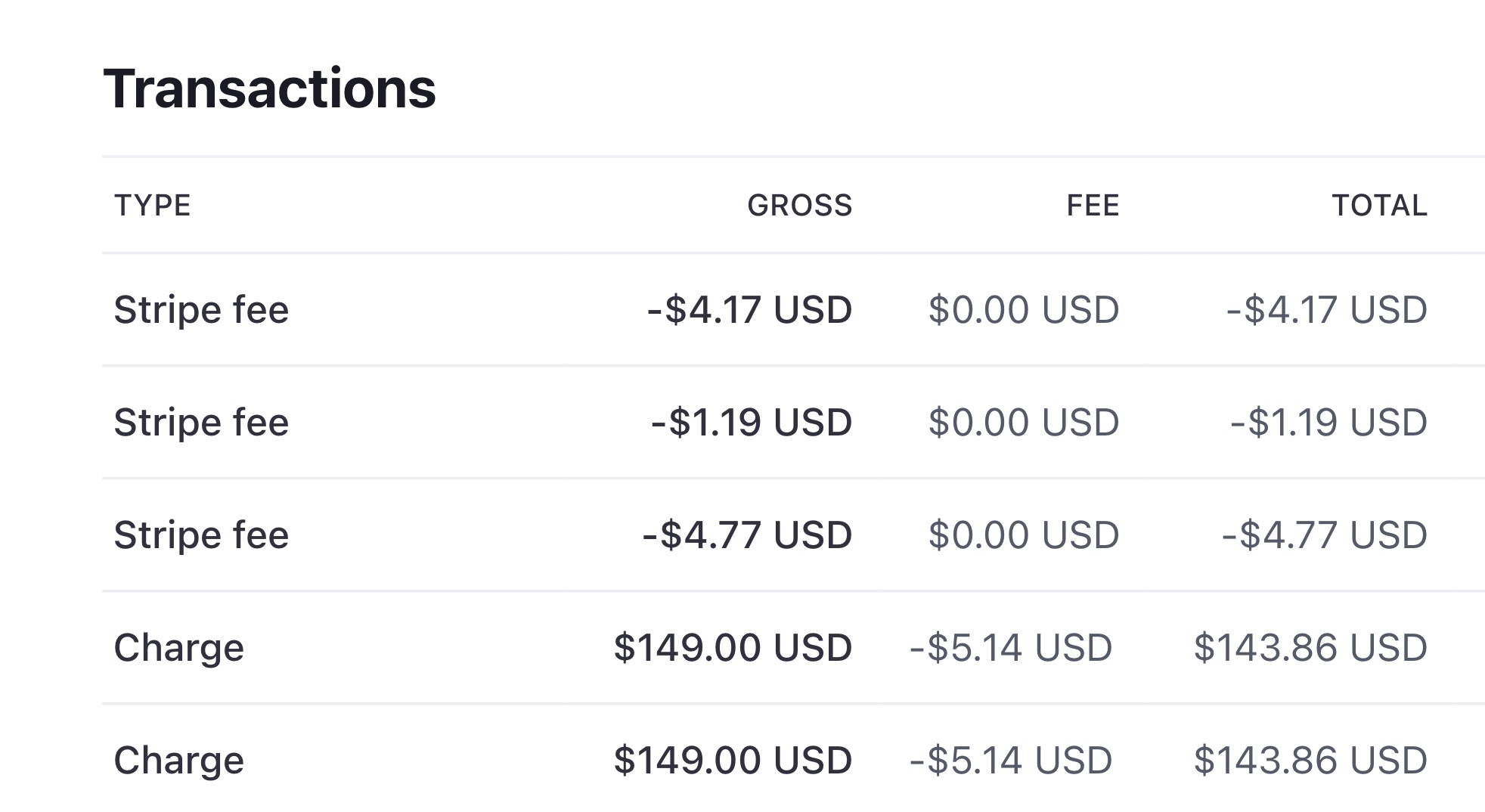

Dispute and Refund Fees

In the event of a dispute (chargeback), Stripe charges a fee of $15.00 per incident (+ $15.00 to counter the dispute). This fee applies whether or not the dispute is resolved in your favor. It's also worth noting that the original transaction fees aren't returned in case of refunds. Here are 5 tips to help you avoid disputes.

Getting Paid with Stripe

Stripe allows flexibility in how and when you get paid. By default, you can expect payouts to your bank account on a 2 to 7 day rolling basis, after the initial transaction. You can also opt for weekly or monthly payouts if that better suits your business operations.

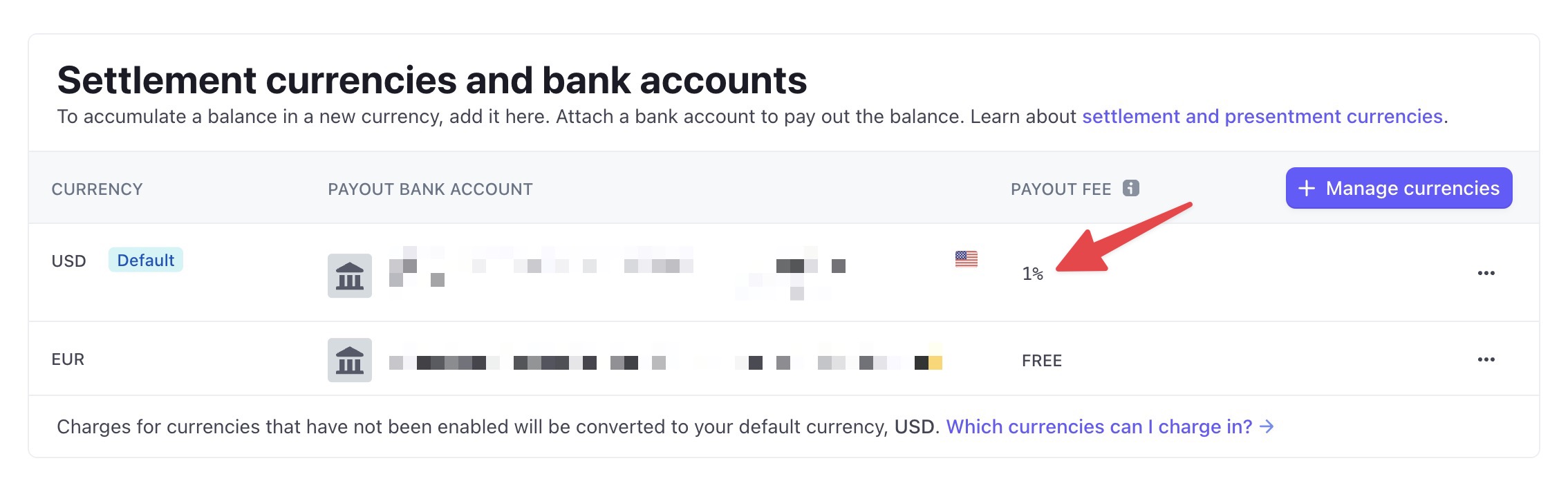

If you're sending money to a bank account outside the country you're operating in, you can expect an additional fee of 1% per payout. You can learn more about Stripe's payout fees with this guide.

Understanding Taxes and Compliance

Depending on your location, Stripe may charge taxes on its services. Make sure to provide accurate tax information to ensure proper invoicing. Stripe's platform is designed to maintain rigorous compliance with financial regulations worldwide, offering peace of mind to its users.

Putting It All Together

Bringing it all together, Stripe’s Standard account offers a straightforward and transparent pricing model. Understanding each fee can give you a clear picture of what to expect and help you calculate the net amount you’ll receive from customer payments. By managing your Stripe transactions effectively, you can optimize your earnings and streamline your payment operations.